Taiwan Semi Is Betting $28 Billion on Rising Demand for Chips

Taiwan Semi Is Betting $28 Billion on Rising Demand for Chips

Jan. 14, 2021 2:42 pm ET

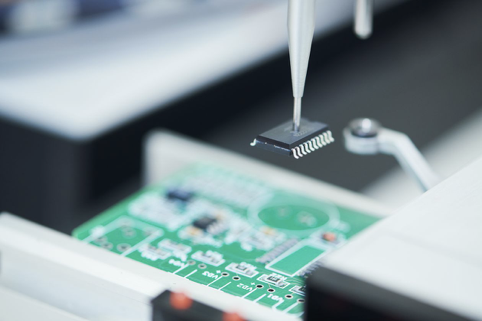

Dreamstime

Amid global shortages of semiconductors ranging from chips for autos to graphics processors, Taiwan Semiconductor Manufacturing said early Thursday it plans to spend $28 billion to increase the capacity of its plants.

Taiwan Semi’s (ticker: TSM) American depositary receipts rose 9% to $129.68 in afternoon trading.

Remarks from executives on a call to discuss the company’s fourth-quarter earnings suggest roughly a 50% increase in capacity investments compared with 2020. Demand for chips is rising worldwide, but capacity was constrained last year. A lackluster 2019 for the industry led to underinvestment in manufacturing capacity and plant shutdowns because of Covid-19 made things worse.

“Usually, historically, when you see TSMC’s capital expenditure numbers, it’s a good leading indicator of how they are seeing demand,” says Brian Bandsma, a portfolio manager at Vontobel Asset Management. “They are very conservative about their capital expenditures number. They’re not going to be overly aggressive.”

Taiwan Semi chairman Mark Liu said on the call that the coronavirus pandemic has boosted demand, which executives expect to continue as vaccines are distributed. There are shortages of products ranging from videogame systems, to automobiles and graphics cards because there are not enough semiconductors to finish them. It’s not clear when shortages will wane, but adjusting manufacturing capacity can take weeks, if not years.

Boosted by the launches of 5G smartphones, and the company’s next- generation process technology—used by Apple (AAPL) for chips in several new personal computers, for example—Taiwan Semi reported fourth-quarter net income of NT$142.77 billion ($5.01 billion), which amounts to NT$5.51 a share. Sales rose 22% to NT$361.53 billion.

New Street Research tech analyst Pierre Ferragu called the fourth-quarter earnings solid, and said that the damage to revenue and profit from the ban on doing business with China’s Huawei has been completely eliminated. Ferragu said that the $25 billion to $28 billion in capital spending suggests that Taiwan Semi is expecting annual revenue of more than $75 billion.

CFO Wendell Huang said that the company expects its first-quarter results to be supported by high-performance computing demand, a recovery in the automotive segment, and a smaller-than-normal season downturn in smartphone demand. The company said it is expecting revenue of NT$354.97 billion to NT$363.35 billion.

The 50% boost in spending on production capacity suggests that the race to dominate semiconductor manufacturing has intensified. In 2019, Samsung Electronics, one of the few other companies capable of profitably manufacturing the world’s most advanced chips, said it planned to spend $116 billion over the next decade to take on the likes of Taiwan Semi, and Intel (INTC). Bandsma described Taiwan Semi as far ahead of Samsung.

Intel meanwhile, has struggled to perfect its next-generation manufacturing technology. Last year, the company said it would be delayed until late 2022, and plans to issue an update when it reports earnings Jan. 21. Investors have speculated that Intel will turn to Taiwan Semi to outsource some of its manufacturing.

- Last: MARKETS ROUNDTABLE Welcome to the Roaring ’20s, but Maybe 2021/1/17

- Next:U.S. Stock Indexes Slide Into the Red as Investors Look Ahea 2021/1/15