China equity – A viable investment for long-term investors

China equity – A viable investment for long-term investors

The COVID-19 epidemic in China is now mostly contained, allowing it to lift restrictions gradually and retraining our focus on the prospect of a post-coronavirus revival and the investment opportunities in the world’s second-largest economy.

On this page

- 1. CHINA IS BACK AT WORK

- 2. SELECTIVE STIMULUS

- 3. EASIER ACCESS TO CHINA A-SHARES

- 4. KEY RISKS ARE MONITORED CLOSELY

- 5. THREE INVESTMENT THEMES FOR LONG-TERM STRUCTURAL GROWTH

- PORTFOLIO STRATEGY OVER THE LONG TERM

Looking at longer-term trends, we believe investors should welcome the gradual inclusion of Chinese companies in global equity indices as they look for diversification and sustainable returns. Valuations that are currently more attractive than those of global equities enhance the opportunity. Furthermore, stock multiples could benefit from the Chinese market becoming more institutional in its makeup.

Below we list a number of reasons for our confidence in Chinese equities.[1]

1. CHINA IS BACK AT WORK

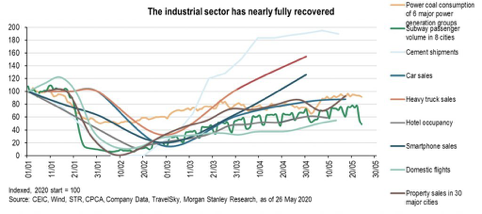

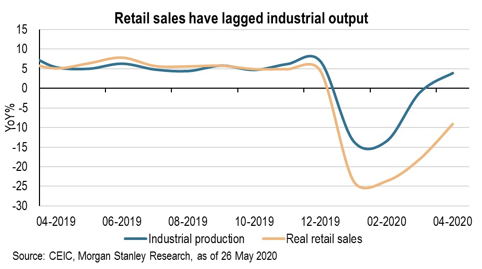

Over the past two months, China’s industry returned to nearly full capacity, even in Hubei region. In the services and consumer sectors, the recovery is progressing more slowly, constrained by partial travel restrictions and the loss of jobs and income. Overall, though, the gradual return to normality underscores how the government’s swift actions enabled the nation to get back on its feet relatively quickly.

Exhibit 1:

Exhibit 2:

2. SELECTIVE STIMULUS

In Q1 2020, China’s GDP contracted by 6.8% year-on-year. Full-year 2020 growth is likely to come in at around 3%, but with risks to the downside, depending on the pandemic’s development globally.

Since the Covid-19 outbreak, the People’s Bank of China (PBoC) has rolled out a series of measures to provide epidemic relief and stabilise demand. During the recent annual National People's Congress, the key focus was the size of fiscal stimulus. Beijing’s spending plans imply a fiscal deficit of 8%-10% of 2020 GDP. This is less than the 12% of GDP deployed after the Global Financial Crisis.

More aggressive stimulus will be needed to support the resumption of normal operations, including more local government investment in infrastructure, education and public health. Tax and fee cuts are likely to support small and medium enterprises along with a lifting of restrictions on car purchases.

3. EASIER ACCESS TO CHINA A-SHARES

The Stock Connect programme linking the Shanghai and Shenzhen markets to Hong Kong, launched in 2014, has made investing in onshore shares easier for international investors. They can deploy capital quickly, and the more than 1 500 stocks listed in Shanghai and Shenzhen offer investors abundant opportunities to earn alpha.

Growing participation by global investors is rendering the A-shares market more mature and is favouring long-term growth. This market provides more diversified access to structural growth opportunities, making it a complement to exposure in the China offshore markets.

As A-shares tend to be less sensitive to global market sentiment, the correlation of this market with the rest of the world is low. Adding A-shares to a portfolio can thus enhance the risk/return profile of emerging market equity exposure and even of a China offshore equity portfolio. We believe an all-China equity solution helps investors gain access to the full opportunity set, maximising the return potential.[2]

4. KEY RISKS ARE MONITORED CLOSELY

Tensions between China and the US remain a focus for investors and we are following the situation closely. One area of attention is the US Holding Foreign Companies Accountable Act. This requires foreign issuers of securities to establish that a foreign government does not own or control them. US-listed foreign companies will be delisted if the accounting oversight board cannot inspect the issuer’s accounting firm for three consecutive years.

We view the near-term risks as manageable. A forced delisting could happen by 2023 at the earliest. In the worst-case scenario, if Chinese American depositary receipts (ADRs) are forced to delist by then, the companies can opt to list in Hong Kong. One e-commerce giant has already done so and other leading companies including a leading online retailer and a prominent internet technology company are seeking to have a secondary listing there this month.[3]

We believe such a law should have a limited impact on the ability of Chinese companies to tap capital markets. Most Chinese firms have issued shares in Hong Kong and Shanghai rather than in the US in the past five years.

Besides, Chinese and US regulators have been negotiating on this oversight-related issue for years. There is still a possibility that compromises by China will allow it to be settled. In such a scenario, US exchanges will try to guide issuers to meet the requirements and maintain their listing in the interest of the exchanges and investors.

5. THREE INVESTMENT THEMES FOR LONG-TERM STRUCTURAL GROWTH

Although digitalisation was already shaping China’s economy, the COVID-19 outbreak has accelerated the trend. We have sharpened our focus on tech localisation themes, cloud businesses, software and hardware.

We continue to see three structural trends that spur sustainable growth:

- Technology innovation: China has shifted towards medium to high-end manufacturing. The size of the domestic market, higher R&D spending and a vast talent pool support this shift.

- Consumption upgrading: We see significant growth opportunities, especially in services. Rising household income, low household debt and more diversified consumer profiles support this trend.

- Industry consolidation: We believe this trend has longer to run in an environment of slower growth. The emergence of leading companies should provide attractive investment opportunities. Faster industry consolidation should play favourably for industry leaders over the long term.

-

PORTFOLIO STRATEGY OVER THE LONG TERM

In summary, while investors should not overlook the risks, we believe China is too big to ignore. It is essential for investors to monitor events closely given the market’s history of volatility. Changes in valuations and earnings may necessitate tactical portfolio adjustments. Navigating China’s waters requires local expertise and a well-resourced investment team to capture the long-term growth opportunities.

Our latest webcast China’s growth challenged covers the economic and market implications for China’s growth of the COVID-19 crisis amid a trade war. We also discuss the policy and structural reform outlook after the recent National People’s Congress. We highlight our long-term portfolio strategy and its focus on structural growth stories.

[1] Click here to watch our China’s growth challenged webcast with Caroline Yu Maurer and Chi Lo

[2] For information on our strategies or investment policies, please contact your dedicated client relationship manager.

[3] Source: China’s JD.com, NetEase Win Hong Kong Approval for Listings.

Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients.

The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns.

Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions).

Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.

- Last:THE REAL VALUE OF CHINA'S STOCK MARKET 2020/12/31

- Next:Fastest Growing Industries in China in 2020 2020/12/29